Introduction

In the intricate world of global finance, currency movements often resemble a complex puzzle, influenced by a myriad of factors from geopolitical events to economic data releases. Recently, the Mexican Peso has caught the attention of investors and analysts by making significant strides against the US Dollar. This remarkable shift follows the latest US inflation data, which shows signs of cooling down. But what does this mean for the broader economic landscape, and why should we care?

Understanding the Peso’s Rally

What’s Happening?

The recent US inflation data has revealed a slowing in the rate at which prices are rising. While this might seem like straightforward good news, it has broader implications, particularly for currency markets. A cooling inflation rate often signals that the Federal Reserve might pause or even reduce interest rate hikes. Lower interest rates can lead to a weaker US Dollar as investors seek higher returns elsewhere. Enter the Mexican Peso.

Why the Peso Benefits

Interest Rate Differentials: When the US Federal Reserve hints at lowering interest rates, investments in the US become less attractive compared to countries where interest rates are higher. Mexico, with its comparatively higher interest rates, becomes a more appealing destination for investors seeking better returns

Economic Stability:

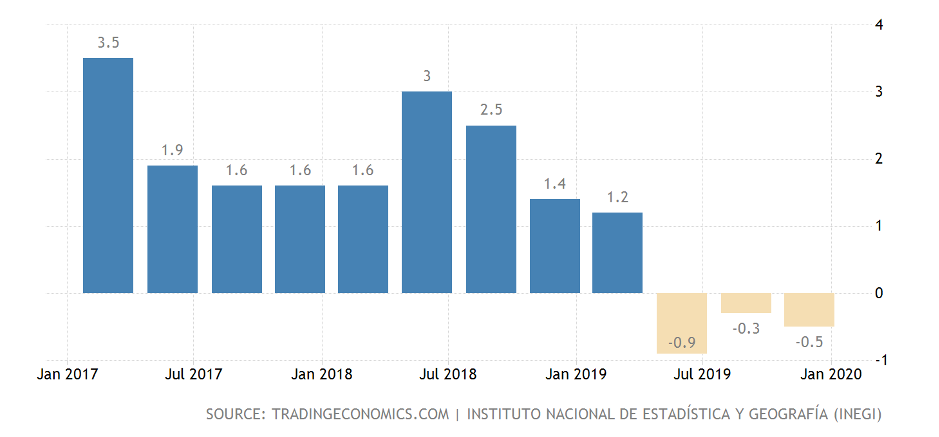

Mexico’s economy has demonstrated resilience, and a strong Peso reflects growing investor confidence. As the Peso gains strength, it becomes more valuable compared to the Dollar, making Mexican exports cheaper and potentially boosting the country’s trade balance

The Human Side of Currency Movements

A Broader Perspective

While it’s easy to get caught up in the day-to-day fluctuations of currency markets, it’s crucial to maintain a broader perspective. Economic indicators like inflation data are just one piece of a larger puzzle. These indicators interact with various other factors, including geopolitical events, trade policies, and global economic trends